Market Insights: Flatbed Volumes Slam Dunk on Dry Van, Reefer, and Rail

Freight/Shipping Trends | Industry News | Logistics | Transportation | Freight Rates | News

Happy March and happy spring! It's that time of year again when we start to see the trees budding, basketballs dribbling, and the transportation industry shifting. March has been an interesting month, with ups and downs across various segments. Dry van and reefer rates dipped while flatbed rates continued their ascent. We'll take a closer look at each of these segments, as well as imports, rail, and fuel prices. Overall, we see some concerning trends in the market, particularly with weak seasonal freight, but there are also bright spots to keep an eye on.

So, grab a cup of coffee as we enjoy the final days of cool weather, and let's dive into what's happening in the world of freight.

March Notables

- Dry van and reefer rates dip

- Seasonal freight is weak

- Capacity remains plentiful

- Flatbed rates continue to improve

- Contract rates are dropping year-over-year

A Look at Rates

Dry Van

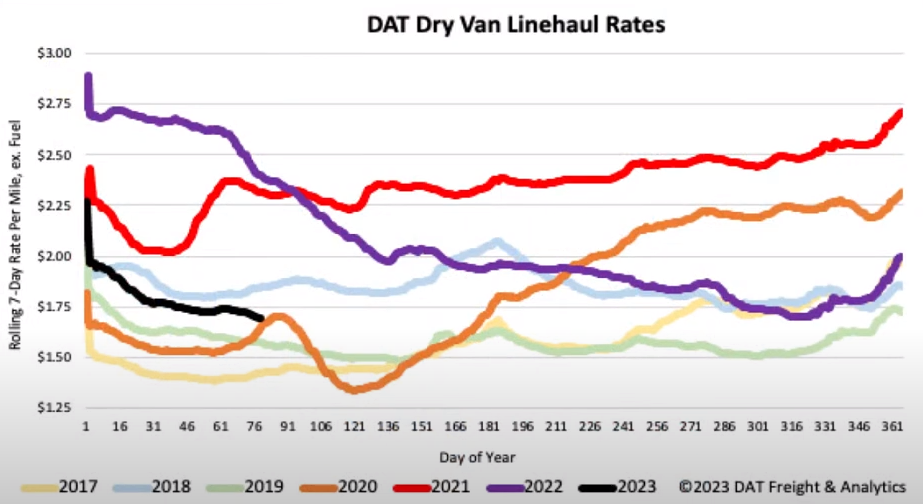

Dry van loads have dropped slightly, about 1% over the last month. This is about 30% lower than the average for the previous six years. Equipment posts on DAT have also continued to jump, keeping availability near all-time highs. Volumes increased in the Southeast by about 6% month-over-month. However, this slight boost has not impacted rates, as capacity remains readily available.

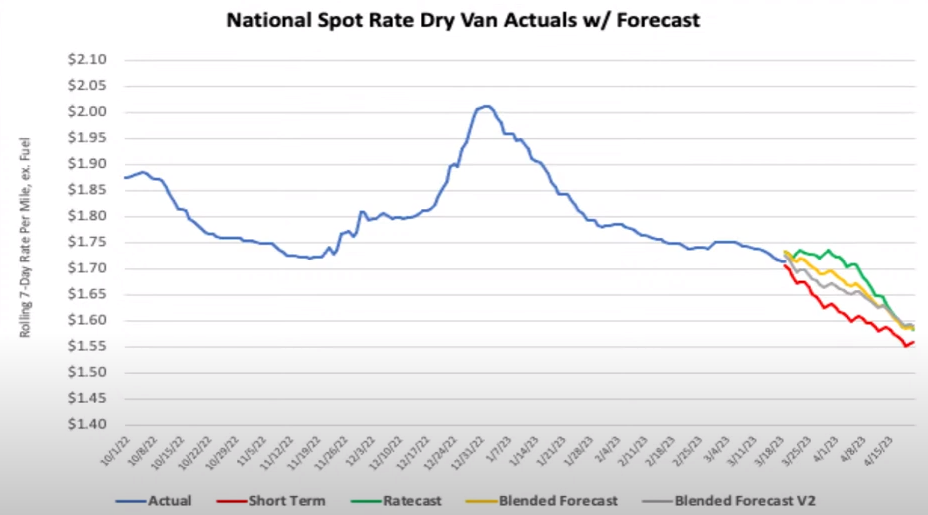

The most significant increase was seen in the Atlanta market. Volumes on the West Coast remain extremely low as imports continue to decline and produce remains weak. On average, dry van spot rates decreased $0.07/mile over the last month and are now $0.74/mile lower year-over-year, about a 26% decrease.

DAT's dry van forecast over the next month is bleak. Typically, seasonal freight begins to push rates up after the middle of March. With volumes down slightly and capacity remaining strong, we continue to see downward pressure. This is something we'll want to keep an eye on. Without the seasonal increase, we can expect rates to remain lower than usual for the remainder of the year. We should still see rates bounce up sometime in the next month or two, but the longer it takes to see the bottom, the lower this year's highs will be.

Reefer

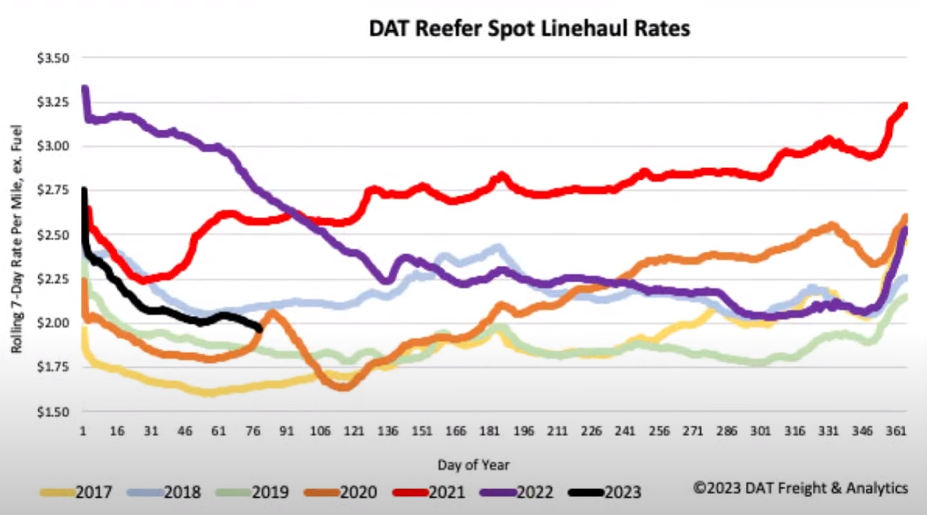

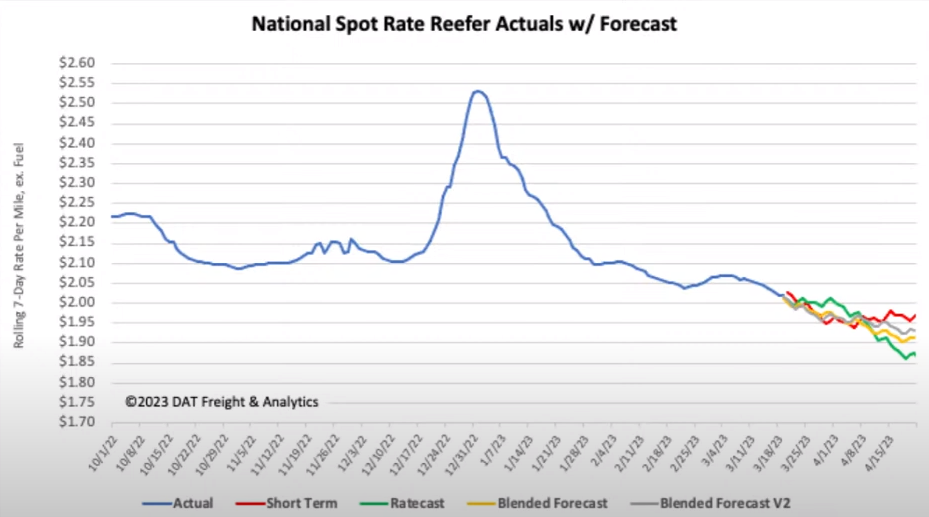

Reefer volumes are significantly down year-over-year, dropping another 2% over the last month to be around 13% lower than this time last year. The slow and weak start to produce season is the main driver for diminished volumes. Capacity remains readily available; the USDA reports only two markets struggling – central Florida and eastern North Carolina. With heavy rains and flooding hampering harvest, California is currently showing an oversupply of trucks. On average, reefer spot rates decreased $0.09/mile over the last month and are now $0.79/mile lower year-over-year, about a 27% decrease.

Similar to DAT's dry van predictions, reefer rates over the next month are not optimistic. We typically see seasonal freight start to push rates up this time of year, but with expectations of a late and weakened produce season, this year's long-term outlook for reefer rates remains low. The forecast does show some signs of bottoming out in mid-April, which would be promising.

Flatbed

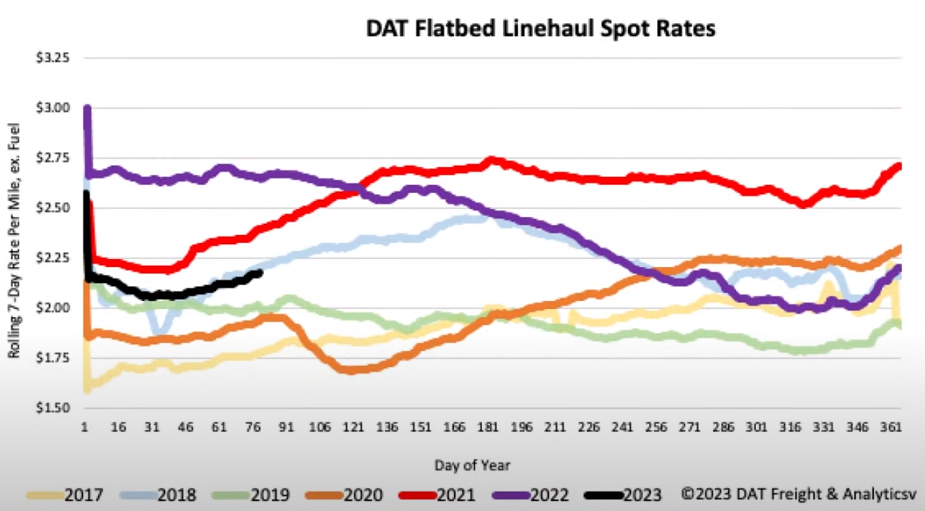

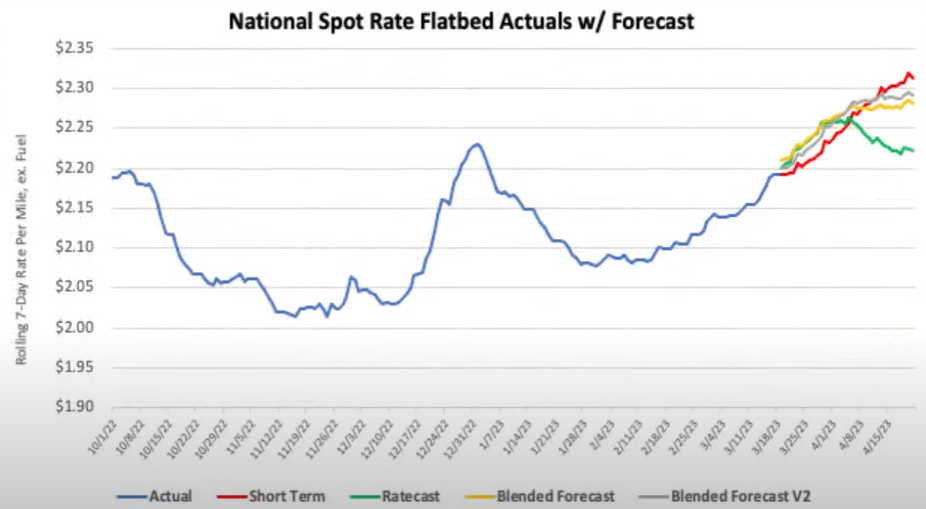

Flatbed volumes have increased for eight straight weeks and are currently at the highest level they've been all year – an increase of just over 30% compared to last month. This is a good sign, but volumes are still 14% lower than the average for the previous six years, while equipment posts on DAT are at their highest level in seven. Building permits are up for the first time this year, with 61% of new construction happening in the Southeast. Good news for the flatbed market, as this is a top driver for demand.

Volumes in the Southeast and Texas are increasing at a steady rate. These two markets will most likely remain the hottest spots for activity over the next few months. Some areas of the Southeast have seen rates increase as much as 15% over the last two months. Flatbed linehaul spot rates are up $0.12/mile over the last month but remain $0.50/mile lower year-over-year.

Compared to van and reefer, the flatbed forecast is much more bullish. We believe these predictions will hold. Typically, flatbed demand starts to pick up in March and spikes through spring as construction and other commercial works pick up.

Imports

According to Global Port Tracker, import volumes weakened month-over-month by around 13.6% and year-over-year by 26.2%. That made February the slowest month since May 2020 – the height of the pandemic. Forecasts do expect container counts to climb at least through mid-summer, but imports will remain below last year's levels by a significant margin. March is trending down 25.9% year-over-year, April is down 17.2%, and May 19.7%. In the first half of 2023, we expect to see 10.9 million fewer containers compared to 2022, a decrease of 19.5%.

Rail

The outlook for rail movements has not increased over the last month. As over-the-road (OTR) rates continue to decrease, rail lines feel the pressure as more shippers convert intermodal moves to OTR. Additionally, weak West Coast imports are a significant concern as the usual seasonal push out is not expected to be particularly strong this year.

Fuel

While we have seen an increase in the price of gasoline over the last month, diesel has dropped an average of $0.19/gallon – an average decrease of $0.95/gallon compared to this time last year. Most experts expect diesel prices to remain relatively steady as we continue into the spring and summer months, averaging $4.16-4.23/gallon.

Stay Informed with Our Monthly Market Trends

That's a wrap for March! If you want to stay updated with the latest news, subscribe to our blog and get our monthly insights delivered straight to your inbox. By subscribing, you'll be the first to know about any changes in the transportation industry, ensuring that you're always one step ahead.

Thank you for reading, and we'll see you next month!

.gif?width=640&height=100&name=Morganh317_March_Agent_Recruiting_Ad_640x100px_MR_10_Mar_2023_V1_R3%20(1).gif)

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)