Market Insights: The U.S. Summed Up in Four Words – "Up in the Air"

Freight/Shipping Trends | Industry News | Logistics | Transportation | Freight Rates | News

As we enter the final quarter of the calendar year, the question, 'Is the U.S. in a recession?' continues to get more complicated.

Almost two-thirds of respondents in a survey of business economists say the U.S. is either already in a recession or has better-than-even odds it will be within the next year. A Bloomberg economic model forecasts a 100% chance of a U.S. recession within the next 12 months, and Goldman Sachs's CEO agreed that there's a reasonable chance of a recession in 2023.

It seems consumers have not gotten the memo, as they're continuing to spend like there's no tomorrow. Executives of travel and credit card companies, the ones with the closest pulse on the American consumer, say that shoppers aren't pulling back spending at all. In fact, American Express's CEO predicts a strong holiday quarter for retail and travel. A puzzling question indeed, considering that consumer spending accounts for about 70% of the U.S. economy.

The stock market has responded in kind to the uncertainty, rising and falling with a volatility much like the Katy Perry hit single, "Hot n Cold." While U.S. stocks have just come off their best week since June, individual investors' portfolios have tumbled 44% from the beginning of January through October 18, per the Financial Times.

Railroads present yet another case of uncertainty as rail carriers return to the drawing board after rail labor unions requested additional benefits. In other words, the question of a rail strike costing the economy millions (if not billions) of dollars a day, like many other things in the U.S. economy right now, is up in the air.

Continue reading on to see how other significant trends, like OPEC production cuts and hurricane season, are affecting the market.

Like what you see? Subscribe to our blog and get our market insights straight into your Inbox monthly.

October Notables

- Spot and contract rates continue to slide.

- Diesel prices spike as OPEC cuts production.

- Imports tick up month-over-month, but forecasts are way down.

- Rail strikes are still a possibility.

- Hurricane season has arrived, but the impact has been minor.

A Look at Rates

Dry Van

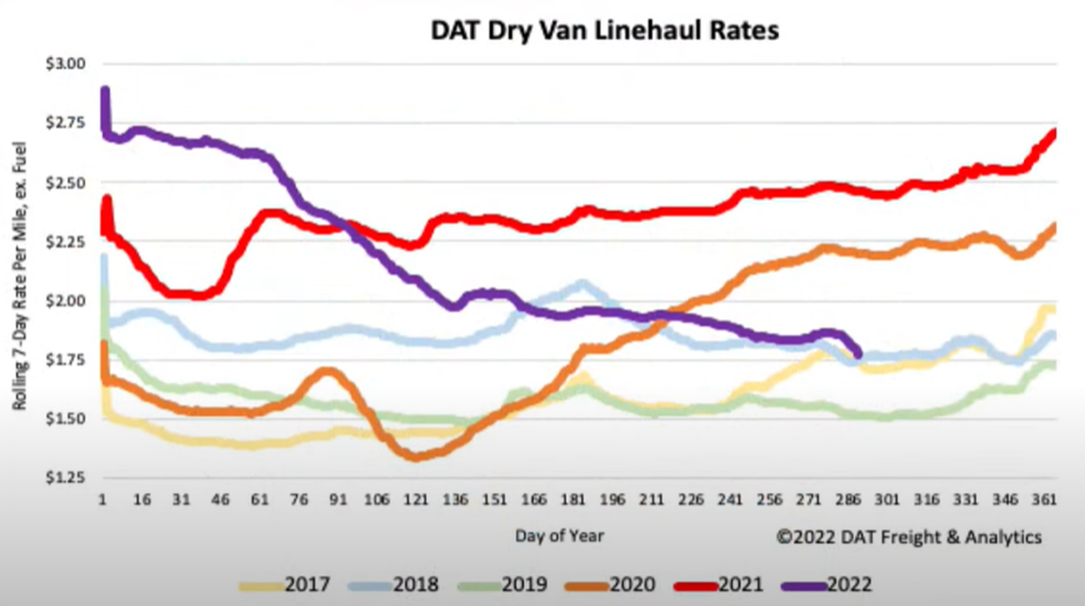

Dry van spot rates have continued their downward trend over the last 3-4 months. Dry van spot rates dropped $0.07/mile over the last week and are down over $0.70/mile y/y. Dry van volumes continue to drop even with retailers prepping for the holiday season.

.png?width=1081&height=606&name=image%20(1).png)

As we predicted last month, rates have continued to decrease. We expect rates to continue their decline until the holidays, when we expect to see short spikes for Thanksgiving, Christmas, and New Year's.

Reefer

-1.png?width=1086&height=611&name=image%20(2)-1.png)

Reefer rates sharply decreased this past month, now down 36% year-to-date. One of the leading causes is the spike in diesel prices. Diesel going up will actually cause linehaul rates to go down. Reefer spot rates dropped $0.11/mile over the last week and $0.74/mile lower y/y. Reefer volumes have fallen, and seasonal produce is lower year-over-year. We are seeing a decrease of about 16% for available loads compared to last month. One of the few areas in the country rates are increasing is the Pacific Northwest. Produce season is in effect, and we have seen rates increase by $0.83/mile over the last three months. We expect rates to continue rising through the end of the year.

-1.png?width=1086&height=605&name=image%20(3)-1.png)

Similar to van rates, we see a decrease in rates continuing until the holidays. The only significant difference is the severity of the drop. Diesel prices impact reefer rates more due to the additional diesel used in the reefer unit. We do expect reefer rates to decrease at a slower pace next month than what we saw this past month.

Flatbed

.png?width=1083&height=613&name=image%20(4).png)

Flatbed spot rates have started to decrease again after a quick spike due to Hurricane Ian. Flatbed load post volumes are still down about 50% compared to this time last year and down 12% compared to the previous month. Flatbed linehaul spot rates are down $0.50/mile y/y and $0.20/mile compared to last month. Even with Hurricane Ian hitting the Southeast, flatbed volumes have remained steady. We saw a quick spike right after Ian hit, but we're already down to levels before Ian made landfall. The only exception is in TX, where we see solid demand as oil fields continue to expand.

.png?width=1084&height=603&name=image%20(5).png)

Due to Hurricane Ian, flatbed rates had a quick spike and dropped this past month. We expect flatbed rates will continue their slow decrease until the holidays next month. Hurricanes significantly impact the flatbed market, so if another storm hits the U.S., expect a quick spike in rates again. Unlike with dry van and reefers, the flatbed market is not impacted by retail, and we do not predict a holiday push.

Imports

Import volumes sank sharply last month, over 12% compared to August. This was the steepest decline in imports month-over-month since the pandemic in 2020. This decline in imports is happening at a seasonally normal time; however, the steepness of the decrease is most likely caused by inflation and the falling global economy. Even with the sharp decline, around 100 container ships are still waiting offshore of North American ports. The East Coast ports remain unusually busy, with an average wait time of ten days.

Rail

The country's third-largest freight rail workers union rejected a temporary agreement brokered by the Biden administration to avert a potentially crippling nationwide railroad strike, raising the possibility that one could occur next month.

In a statement last week, the Brotherhood of Maintenance of Way Employees Division of the Teamsters said 56% of its almost 12,000 workers had voted against the tentative agreement.

The Associated Press reported that the union will delay any strike until five days after Congress reconvenes in mid-November to allow time for additional negotiations.

Four unions have ratified contracts based on the agreement brokered by the White House, while seven have votes pending on the deal. The eleven unions represent about 115,000 rail workers.

The two largest rail unions -- the Brotherhood of Locomotive Engineers Trainmen, or BLET, and the SMART Transportation Division, or SMART-TD, which make up roughly half of all rail workers -- are set to finish voting in the middle of next month.

Fuel

Expect more pain at the pump as OPEC announced they are reducing production by two million barrels per day. As a result, oil pricing increased to over $90 for the first time in several weeks. Diesel rates shot up over $0.50/gal over the last two weeks.

About Brad Loeb

An expert in market trends, cost analysis, and rate/route selection, Brad serves as Armstrong’s Director of Pricing and Analytics. He joined Armstrong in 2019, bringing nine years of experience in supply chain and operations management, with industry knowledge spanning warehousing, pricing, freight, LTL, and 3PL.

.jpg)